The Blockchain Future Of Air Travel

Accounting Help

Designed properly, phantom stock plans share the value growth of the business with the phantom stock plan individuals in much the same manner as the equity shareholders share the expansion. Although there are necessary tax variations—phantom inventory plans pay compensation, that are taxable as wages, while equity shareholders enjoy how to calculate phantom profit dividends and capital positive aspects—the worth proposition could be very a lot the same. Earnings value formulas generally use earnings earlier than interest, earnings taxes, depreciation and amortization (“EBITDA”) as a proxy for the operating money flows of the enterprise multiplied by a factor to find out enterprise value.

If you’re fortunate, Sally gained’t be thinking about those details. She’ll belief you and be actually grateful for the award—so she won’t want to cause issues. Your award of inventory to Sally leads to an immediate tax value for her. Let’s say your accountant tells you your inventory is worth $10 per share.

That would give the phantom stockholder a profit of $20,000. If you personal 10 percent of shares in an organization that earns $50,000 in earnings for the year, $5,000 in revenue will be reported to the IRS. However, if that earnings is not paid out to you in dividends, as an alternative being rolled over into retained earnings, it can depart you saddled with taxes for revenue you never https://cryptolisting.org/blog/how-is-phantom-profit-calculated earned. If you are a former partner who was purchased out earlier in the 12 months, you may be assessed for phantom income. If you are interested in a business based on your labor — sometimes referred to as sweat equity — you also could also be assessed for phantom revenue at the finish of the year.

Phantom Profits

By the best way, when you do buy them again how will the worth be determined? Making staff shareholders opens up a Pandora’s Box of potential headaches. Stock choices (actual ones) are enticing because https://cex.io/ they’re “win-win.” Employees solely win if the other shareholders win (by seeing their inventory price go up by a worth that exceeds the quantity by which they had been diluted).

Phantom Profit: Fifo And Lifo

In its first month of operation, Maze Company purchased a hundred models of stock for $6, then 200 units for $7, and eventually 150 units for $eight. Compute the quantity of phantom revenue that might end result if the company %keywords% used FIFO quite than LIFO. Explain why this amount is known as phantom revenue. This is commonly referred to as a Deferred Stock Unit plan—a form of deferred compensation. Said in another way, Sally would “convert” some of her future pay to phantom stock.

In a public company surroundings there are markets that help to deal with the exercise of the option. Instead, the worker and the company sponsor have to work out the cash flow mechanics of the exercise https://www.binance.com/. And there’s no “cashless train” arrangement that permits the employee to get a reduced variety of shares by surrendering a portion of his choices to cover the strike price.

- It’s true that had she obtained actual inventory (and paid the taxes up entrance) she might have saved some taxes in the long term.

- Well, remember that with precise stock awards Sally would pay taxes when she received the grant or when the vesting lapsed.

- In this way, she by no means has to pay earnings taxes till she’s in receipt of the particular cash.

- In the first case (precise inventory), your deduction was for $50,000, thus a tax advantage of $20,000 (assuming forty% bracket).

Under the terms of the agreement, the employee should stay with the firm for 5 years, for example, to benefit from the phantom stock deal. This timeframe requirement is named the “vesting” period. To qualify as a profits curiosity for tax purposes, income pursuits must be granted with a liquidation value of $zero.

With the phantom stock instance, you get to deduct the complete $90,000, resulting in a tax good thing about $36,000. If you’re feeling responsible about Sally’s taxes go ahead and give her more shares, sufficient to end in your “after-tax cost” being the same. More formally, this is called a Restricted Stock Grant (or certainly one of its variations). She could wish to focus on the brand new compensation program—hers and yours! Of course, you’ll management the majority of the shares and the ultimate selections.

Small enterprise owners could make phantom stock agreements with key staff, however fail to say these agreements to their monetary advisors, particularly, but not completely, when the agreements are verbal. Despite an influence on worth and the reporting necessities, the settlement is regularly ignored until exercised.

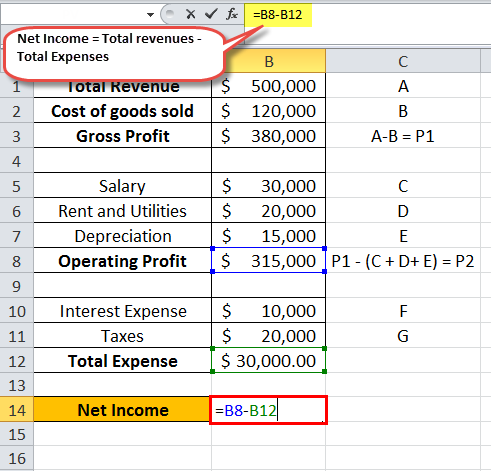

Calculating Phantom Profit

Instead, phantom shares are given to employees with no money changing palms. That’s a big benefit to employees, who share within the stock’s profits without having to pay for it.

For example, the plan may create a hundred items of which 10 (10 %) could also be granted to phantom individuals and ninety (ninety percent) symbolize the pursuits of the real shares. Thus, every phantom unit is equal to at least one % of the worth of the corporate. Unitizing the plan on this manner makes the math simpler. For example, Company X sells products which are petroleum based mostly. The historic value utilizing the first-in, first-out (FIFO) cost circulate might need resulted in $100 per unit showing as the cost of items sold on the latest earnings assertion.

A phantom inventory plan is a contractual agreement wherein an organization promises to make cash funds to workers upon the achievement of certain conditions. Just as with inventory awards, the aim of a phantom inventory plan is to generate an ownership mentality and reward key employees for serving to to grow the business worth. For instance, firms should strictly adhere to the Internal Revenue Service’s (IRS) Tax rule 409A statute. This rule limits a company how to calculate phantom profit’s choices in instituting distribution dates and likewise blocks employees and managers from accelerating phantom stock payouts if they deem the corporate to be in extreme monetary stress. For workers, the company calls all the photographs in a phantom fairness deal, giving them little management or maneuverability if the share worth goes south.

Stocks Are Subjected To “Phantom Profit” Manipulation

The problem associated with phantom income is that it could unfairly add to an individual’s tax burden. Come tax time, many partners and investors in small companies are stunned to obtain a Schedule K-1 kind reporting shares of a business’s income that they by no means truly acquired as income. If the reported phantom earnings is substantial, an individual may be unable to pay his tax bill in a timely method. Apart from all other difficulties, vested interests stand in the best way of «scientific» accounting. On the one hand, the Securities and Exchange Commission needs a company to make adjustments for inflation so as to not give investors an exaggerated idea of its profitability.

+7 (918) 4-333-108

+7 (918) 4-333-108