Types of Accounting

balance sheet equation in Accounting

It calculates the total revenue, then the net income, whereby dividends are paid to partners. It represents the amount ‘permanently’ contributed by the owners (though this is a simplification). Normally the remainder of the owners’ equity is profit made by the company QuickBooks but not yet distributed to the owners. This explanation is an oversimplification as there are different classes of share capital — each with different rights and different types of reserves. Sundry refers to the assorted expenses needed to operate an organization.

She provided the service to the customer, and there is a reasonable expectation that the customer will pay at the later date. There also does not have to be a correlation between when cash is collected and when revenue is recognized. A customer may not pay for the service on the day it was provided.

It is common for the notes to the financial statements to be pages in length. Go to the website for a company whose stock is publicly traded and locate its annual report.

If you’re reading a corporation’s financial reports, what you see is based on accrual accounting. An accounting professional may choose from a wide range of employment scenarios and desired amenities to match What is bookkeeping their ideal career situation. Options include fast-paced positions that change often and may feature significant travel, to more standard positions that provide stable working conditions and responsibilities.

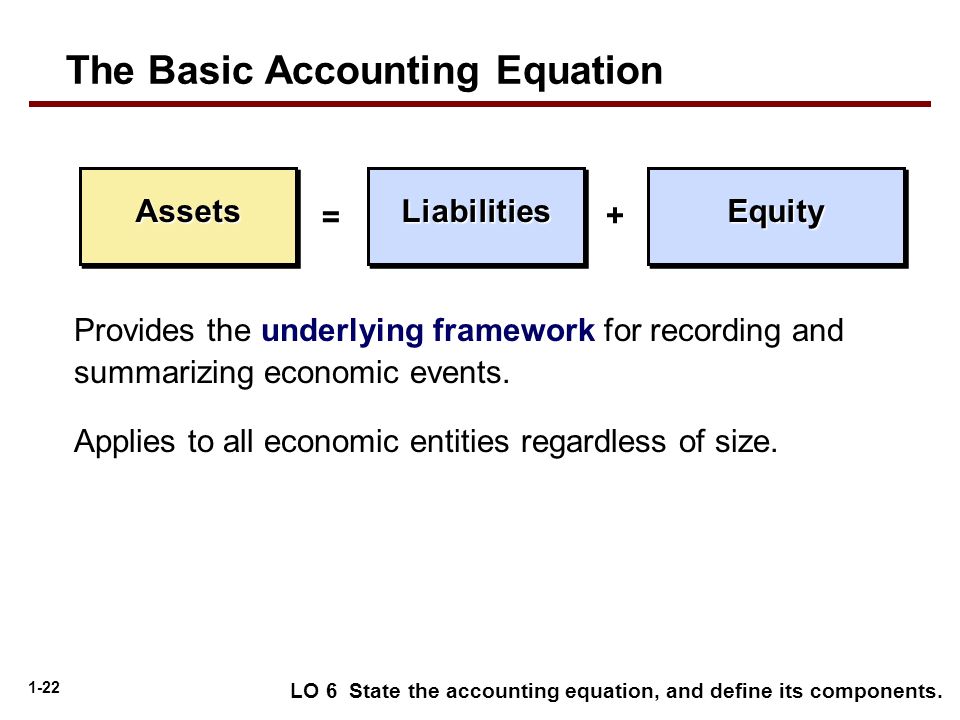

What is the Accounting Equation?

Even though the customer has not yet paid cash, there is a reasonable expectation that the customer will pay in the future. Since the company has provided the service, it would recognize the revenue as earned, even though cash has yet to be collected. Once an accounting standard has been written for US GAAP, the FASB often offers QuickBooks clarification on how the standard should be applied. Businesses frequently ask for guidance for their particular industry. When the FASB creates accounting standards and any subsequent clarifications or guidance, it only has to consider the effects of those standards, clarifications, or guidance on US-based companies.

Andra Picincu is a digital marketing consultant with over 10 years of experience. She works closely with small businesses and large organizations alike to help them grow and increase brand awareness. She holds a BA in Marketing and International Business and a BA in Psychology. Over the past decade, she has turned her passion for marketing and writing into a successful business with an international audience. Current and former clients include The HOTH, Bisnode Sverige, Nutracelle, CLICK — The Coffee Lover’s Protein Drink, InstaCuppa, Marketgoo, GoHarvey, Internet Brands, and more.

Even though Lynn feels the equipment is worth $60,000, she may only record the cost she paid for the https://sootandtye.com/2020/01/16/how-to-correctly-calculate-report-and-reverse/ equipment of $40,000. For example, Lynn Sanders owns a small printing company, Printing Plus.

What are the 5 types of accounts?

Most accounting balance sheets classify a company’s assets and liabilities into distinctive groupings such as Current Assets; Property, Plant, and Equipment; Current Liabilities; etc. The following balance sheet example is a classified balance sheet.

Definition of ’balance sheet equation’

This means that FASB has only one major legal system and government to consider. This means that interpretation and guidance on US GAAP standards can often contain specific details and guidelines in order to help align the accounting process with legal matters and tax laws. I suppose it’s not «required,» but I would say it’s necessary.

- Financial professionals will use the balance sheet to evaluate the financial health of the company.

- Liabilities increase on the credit side and decrease on the debit side.

- For a company keeping accurate accounts, every single business transaction will be represented in at least of its two accounts.

Debtors go in one column and creditors in another so they may be used to determine the status of the organization. Recalculate the retained earnings balance and make sure it uses the right data from the general ledger. However, there are more ways to troubleshoot your balance sheet.

The customer did not pay cash for the service at that time and was billed for the service, paying at a later date. When should Lynn recognize the revenue, on August 10 or at the later payment date?

This lists all the balances from all the accounts in the Ledger. Notice that the values are not posted to the trial balance, they are merely copied. It is important you do not think of debit movements and credit movements as “pluses and minuses” or “good and bad”. Using the above chart, you can see that a debit movement has the ability to both increase and decrease an account, as does a credit movement. So, in summary, we need to record a transaction that will increase expenses and decrease bank.

In her daily life, Ms. Picincu provides digital marketing consulting and copywriting services. Her goal is to help businesses understand and reach their target audience in new, creative ways. The expense recognition principle requires that expenses incurred match with revenues earned in the same period. Once an asset is recorded on the books, the value of that asset must remain at its historical cost, even if its value in the market changes.

Public Accounting

For example, Lynn Sanders purchases a piece of equipment for $40,000. She believes this basic accounting equation is a bargain and perceives the value to be more at $60,000 in the current market.

What is rules of accounting?

“The three financial statements are the income statement, balance sheet, and statement of cash flows. The income statement is a statement that illustrates the profitability of the company. It begins with the revenue line and after subtracting various expenses arrives at net income.

Cost accounting is the accounting method that is used for capturing the various cost of production of the company by assessing these costs like input cost, fixed cost, etc. In the cost accounting, all the costs will first be assessed and then it will be compared with the actual cost incurred by the company in order to analyze the variance thereof. On the basis of the basis, the company can take corrective actions in a far better way. Accounting of the matters related to the tax comes under tax accounting. It involves compliance with various tax-related statutes along with the tax planning with the aim of preparation of tax returns.

You might not finish putting together the balance sheet until several weeks after the end of the fiscal year (Dec. 31 for example), but your data collection end date and balance sheet date would still be December 31. Examples of this kind of transaction include cash/bank and rent. All incorporated companies must use accrual accounting according to the generally accepted accounting principles (GAAP).

Start with the assets that can be converted to cash most easily. Any cash assets should be listed first because they’re already liquid. Beneath it, list the name of the organization, and the effective date of the balance sheet (the last day of the quarter or fiscal year).

Equity Account

Also, when we pay expenses, our bank account is obviously going to go down. Cost accountants also analyze actual costs versus budgets or standards to help determine future courses of action regarding the company’s cost management. Often times considered as a subset of management accounting, cost accounting refers to the recording, presentation, and analysis of manufacturing costs. Cost accounting is very useful in manufacturing businesses since they have the most complicated costing process.

This process involves the calculation of income tax and various other taxes and their timely payment to the tax authorities. There are different branches of accounting, each serving a different purpose. The various accounting system helps in gathering and maintaining the records in a proper manner so that those data can be used in various reports. It creates a system within the business with many inherent checks to highlight the mistake or fraud.

+7 (918) 4-333-108

+7 (918) 4-333-108