Understanding Accounting Methods

This can help you determine which aspects of your business should receive more money, and which are in need of support. Income statement analysis of this kind can also help with forecasting and assessing risk, as it gives you a clear idea of how certain initiatives translate into earnings. Your balance sheet shows data points for just one moment in time.

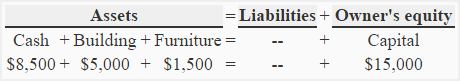

Current liabilities are added to the owner’s equity, but fixed liabilities are not. Start with the assets that can be converted to cash most easily. Any cash assets should be listed basic accounting equation first because they’re already liquid. Beneath it, list the name of the organization, and the effective date of the balance sheet (the last day of the quarter or fiscal year).

What are the six branches of accounting?

accounting process, is a series of procedures in the collection, processing, and communication of financial information. accounting involves recording, classifying, summarizing, and interpreting financial information. Process of Accounting Steps: 1. Identifying and Analyzing Business Transactions.

Expenses Account

Current and former clients include The HOTH, Bisnode Sverige, Nutracelle, CLICK — The Coffee Lover’s Protein Drink, InstaCuppa, Marketgoo, GoHarvey, Internet Brands, and more. In her daily life, Ms. Picincu provides digital marketing consulting and copywriting services.

A customer may not pay for the service on the day it was provided. Even though the customer has not yet paid cash, there is a reasonable expectation that the customer will pay in the future. Since the company has provided the service, it would recognize the revenue as earned, even though cash has yet to be collected. Once an accounting standard has been written for US GAAP, the FASB often offers clarification on how the standard should be applied. Businesses frequently ask for guidance for their particular industry.

A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. At the first level of the equation, on the left, debits increase, on the right, credits increase.

This explanation is an oversimplification as there are different classes of share capital — each with different rights and different types of reserves. Sundry refers to the assorted expenses needed to operate an organization. Debtors go in one column and creditors in another so they may be used to determine the status of the organization.

Accounting Equation

When the FASB creates accounting standards and any subsequent clarifications or guidance, it only has to consider the effects of those standards, contra asset account clarifications, or guidance on US-based companies. This means that FASB has only one major legal system and government to consider.

This means that interpretation and guidance on US GAAP standards can often contain specific details and guidelines in order to help align the accounting process with legal matters and tax laws. I suppose it’s not «required,» but I would say it’s necessary. It calculates the total revenue, then the net income, whereby dividends are paid to partners. It represents the amount ‘permanently’ contributed by the owners (though this is a simplification). Normally the remainder of the owners’ equity is profit made by the company but not yet distributed to the owners.

The sum of the debits must equal the sum of the credits for each transaction. For example, Lynn Sanders owns a small printing company, Printing Plus. The customer did not pay cash for the service at that time and was billed for the service, paying at a later date.

If, for example, your profits are on a consistent downward trend, it could be a red flag for lenders. By analyzing your income statement, you can pinpoint what aspects of your operation are correlated with high-growth periods and what aspects lead to stagnation.

- The amount of the transaction is recorded in the final column.

- These accounts are related to individuals, firms, companies, etc.

- The primary reason for this distinction is that the typical company can have several to thousands of owners, and the financial statements for corporations require a greater amount of complexity.

Revenue or Income

Cost accounting is very useful in manufacturing businesses since they have the most complicated costing process. It is common for the notes to the financial statements to be pages in length. Go to the website for a company whose stock is publicly traded and locate its annual report. Cost accounting is the accounting method that is used for capturing the various cost of production of the company by assessing these costs like input cost, fixed cost, etc.

Her goal is to help businesses understand and reach their target audience in new, creative ways. The expense recognition principle requires that expenses incurred match with revenues earned in the same period.

Debits and Credits

In the cost accounting, all the costs will first be assessed and then it will be compared with the actual cost incurred by the company in order to analyze the variance thereof. On the basis of the basis, the company can take corrective actions in a far better way. Accounting of the matters related to the tax comes under tax accounting.

It involves compliance with various tax-related statutes along with the tax planning with the aim of preparation of tax returns. This process involves the calculation of income tax and various other taxes and their timely payment to the tax authorities. There are different branches of accounting, cash basis vs accrual basis accounting each serving a different purpose. The various accounting system helps in gathering and maintaining the records in a proper manner so that those data can be used in various reports. It creates a system within the business with many inherent checks to highlight the mistake or fraud.

What Is a Cash Book?

Debits and credits are opposite , for any one type of account. While a T-Account is useful for quickly summarising an account’s balance, it only contains a fraction of the information that was recorded in the Journal. As it shows in the example above, the balance of a T-account can be figured by first totaling each column. Second, subtract the smaller subtotal from the larger, and finally placing the total in the larger number’s column. The accountant produces a number of adjustments which make sure that the values comply with accounting principles.

When should Lynn recognize the revenue, on August 10 or at the later payment date? She provided the service to the customer, and there is a reasonable expectation https://training.khusheim.com/1-800accountant-3/ that the customer will pay at the later date. There also does not have to be a correlation between when cash is collected and when revenue is recognized.

A thorough understanding of your balance sheet allows for better budgeting, which is a crucial and underrated aspect of financial management. With an accurate budget, a business can plan operations, coordinate activities, and better communicate high-level plans to various managers. The balance sheet provides a snapshot of your financial position at one moment in time, and allows adjusting entries you to figure out your solvency vs. liquidity ratios, which are important for managing debt. Book value of equity per share (BVPS) measures a company’s book value on a per-share basis. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

What are the basic accounts?

The famous branches or types of accounting include: financial accounting, managerial accounting, cost accounting, auditing, taxation, AIS, fiduciary, and forensic accounting.

That’s like a one-time blood test saying your cholesterol was 250 on April 30th, 2019. That’s like multiple blood tests showing that your cholesterol has gone up 15% per month over the last six months (and your doctor might tell you to cut back on the burgers). You can think of the relationship between the income statement and balance sheet in terms of getting tests at the doctor’s office.

These values are then passed through the accounting system resulting in an adjusted trial balance. Cost accountants also analyze actual costs versus budgets or standards to help determine future courses of action regarding the company’s cost management. Often times considered as a subset of management accounting, cost accounting refers to the recording, presentation, and analysis of manufacturing costs.

Andra Picincu is a digital marketing consultant with over 10 years of experience. She works closely with small businesses and large organizations alike to help them grow and increase brand awareness. She holds a BA in Marketing and International Business and a BA in Psychology. Over the past decade, she has turned her passion for marketing and writing into a successful business with an international audience.

+7 (918) 4-333-108

+7 (918) 4-333-108