normal account balance definition and meaning

normal account balance definition and meaning

Section: Accounting Tutorial: Making Sense of Debits and Credits

This expectation is based on an account’s classification within the chart of accounts. For example, if an asset account has a credit balance, rather than its normal debit balance, then it is said to have a negative balance.

The asset account above has been added to by a debit value X, i.e. the balance has increased by £X or $X. Before the advent of computerised accounting, manual accounting procedure used a book (known as a ledger) for each T-account. The collection of all these books was called the general ledger.

The Differences Between Debit & Credit in Accounting

This can create some confusion for inexperienced business owners, who see the same funds used as a credit in one area but a debit in the other. A general rule is that asset accounts will normally have debit balances. Liability and stockholders’ equity accounts will normally have credit balances.

But if you start with a negative number and add a positive number to it (debit), you get a smaller negative number because you move to the right on the number line. A negative balance is an indicator that an incorrect accounting transaction may have been entered into an account, and should be investigated. Usually, it https://www.bookstime.com/ either means that the debits and credits were accidentally reversed, or that the wrong account was used as part of a journal entry. Thus, when closing the books at the end of an accounting period, the investigation of negative account balances is a standard procedure that may uncover several transaction mistakes.

A debit to one account can be balanced by more than one credit to other accounts, and vice versa. normal balance For all transactions, the total debits must be equal to the total credits and therefore balance.

If you fully understand the above, you will find it much easier to determine which accounts need to be debited and credited in your transactions. Modern accounting software helps us when it comes to Cash.

Finally, credit is an entry that depicts In accounting to increase asset or decrease liability. So a credit increases net income on the company’s income statement while debit reduces net income. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short-term. Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset.

- The complete accounting equation based on modern approach is very easy to remember if you focus on Assets, Expenses, Costs, Dividends (highlighted in chart).

- Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period.

- ‘Debit’ is a formal bookkeeping and accounting term that comes from the Latin word debere, which means «to owe».

- The Profit and Loss Statement is an expansion of the Retained Earnings Account.

- Since this account is an Asset, the increase is a debit.

- Accounts with a net Debit balance are generally shown as Assets, while accounts with a net Credit balance are generally shown as Liabilities.

There is no upper limit to the number of accounts involved in a transaction — but the minimum is no less than two accounts. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. Liability, Equity, and Revenue accounts usually receive credits, so they maintain negative balances. Accounting books will say “Accounts that normally maintain a negative balance are increased with a Credit and decreased with a Debit.” Again, look at the number line. If you add a negative number (credit) to a negative number, you get a larger negative number!

![]()

However, its accounts payable field also increases by the amount of the purchase, adding a liability to the company. Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt.

When you enter a deposit, most software such as QuickBooks automatically debits Cash so you just need to choose which account should receive the credit. And when writing a check, the software automatically credits Cash, so you just need to select the account to receive the debit (perhaps an Expense account). Properly establishing your chart of accounts in accounting software, and diligently noting which account a debit or credit belongs to, enables the program to apply the debits and credits properly. You buy supplies from a wholesaler on credit for a total of $500.

Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less. If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser. Essentially, the company has accepted a short-term IOU from its client.

Revenue accounts will have credit balances (since revenues will increase stockholders’ or owner’s equity). Expense accounts will normally have debit balances as they cause stockholders’ and owner’s how to prepare a statement of retained earnings equity to decrease. Each transaction that takes place within the business will consist of at least one debit to a specific account and at least one credit to another specific account.

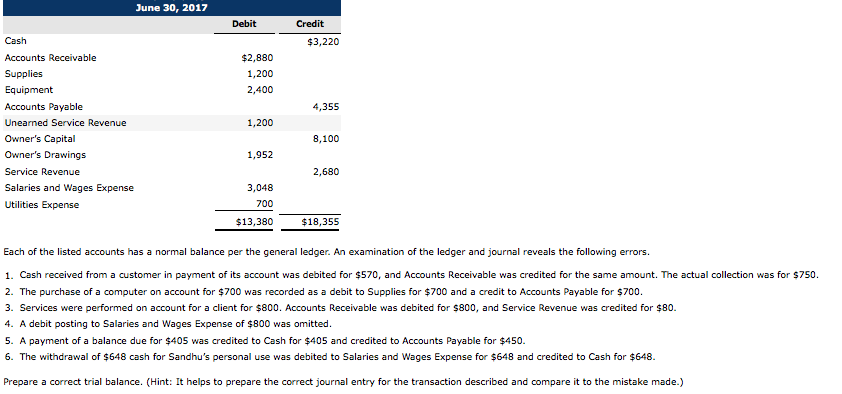

The chart of accounts is the table of contents of the general ledger. Totaling of all debits and credits in the general ledger at the end of a financial period is known as trial balance. Debits and credits are used to monitor incoming and outgoing money in your business account. In a simple system, a debit is money going out of the account, whereas a credit is money coming in. However, most businesses use a double-entry system for accounting.

Additionally, if a company buys something on credit, its accounts must record the transaction several places in its balance sheet. To explain, imagine that a company dividends normal balance buys merchandise on credit. After the purchase, the company’s inventory account increases by the amount of the purchase, adding an asset to the company.

You would debit the supplies expense and credit the accounts payable account. By using the double-entry system, the business owner has a true understanding of the financial health of his company.

He knows that he has a specific amount of actual cash on hand, with the exact amount of debt and payables he has to fulfill. A negative balance occurs when the ending balance in an accounting record is the reverse of the expected normal balance.

+7 (918) 4-333-108

+7 (918) 4-333-108